Happy Labor Day. I have finally created a website to better manage this content. Do check it out at www.theinvestment411.com. Your feedback is very welcome and appreciated.

The employment report for August brought some mixed results:

· Non-farm payrolls: +315,000 vs. +298,000 expected

· Unemployment rate: 3.7% vs. 3.5% expected

The labor force participation rate in August also registered a notable uptick, to 62.4% from 62.1% the prior month, matching the highest level since March 2020.

The bad news of a slight increase of unemployment is good news on the inflation front. This is a sign that more people are actively looking for work, or that there is a higher labor supply. The Bureau of Labor Statistics is set to release the August Consumer Price Index report on Sept. 13, which should show whether the slowdown of inflation we saw in July has continued.

Despite the clear message of the goal to bring the interest rate to the targeted 2%, the stock market is obsessed with speculating about a 75 or 50 point increase in September. Realistic estimates point to inflation being lowered to the target 2% sometime in early 2024. For the remainder of 2022, we could expect some leveling of interest rate increases and, for most 2023, retaining the same interest level.

“For all of its uncertainty, we cannot flee the future.” — Barbara Jordan

One of the drivers for slightly lower inflation in July was the lower oil prices in the past three months, due to concerns of an economic slowdown in China from COVID lockdowns. China’s economy barely avoided a contraction during the April-June quarter, as lockdowns and border controls pummeled its economic activity.

Lockdown measures in China seem to be easing, however, as new infections show signs of stabilizing. China has also stepped up its economic stimulus with a further 1 trillion yuan ($146 billion) of funding largely focused on infrastructure spending. Still, this support likely won’t go far enough to counter the damage from repeated COVID lockdowns and a property market slump.

TRENDS

The stock market is down again since the Fed conference and the message of containing inflation, after an early August reprieve. Markets are now uncertain about whether the Fed will hike rates by 0.50 or 0.75 percentage points at September’s meeting. And by December, current market expectations have moved toward a target for the federal-funds rate of 3.75% to 4.0%, from an average of 0.08% in 2021.

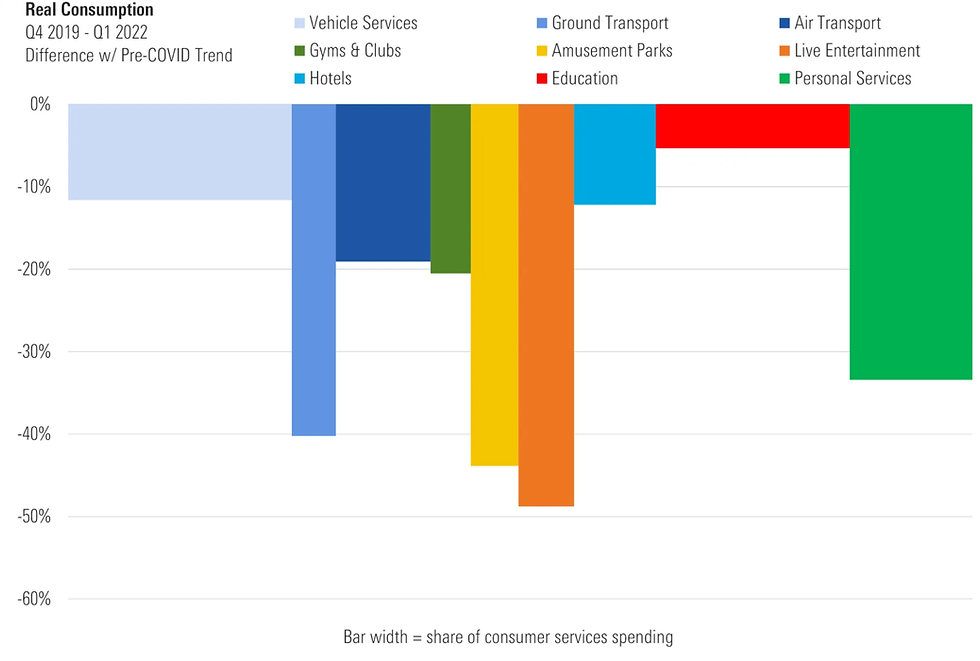

When the pandemic hit us in March 2020, consumer spending rapidly shifted into pantry-loading, electronics to support working from home, and home renovations. Consumer spending in the service industry was broadly affected to varying degrees, as you see in the chart below:

The current deviation in spending on goods and services will converge back to their pre-pandemic trends by mid-2023. Recreation and transportation have the most ground to cover when it comes to returning to pre-pandemic trends.

OPPORTUNITIES

I Bond

A risk-free investment for anyone at the moment are Series I Savings Bonds, or I bonds. With interest rates adjusted for inflation every six months, the current I bonds — issued through Oct. 22, 2022 — yield 9.62%. You can buy directly from the treasury at https://www.treasurydirect.gov/.

Service Sector Companies

Much of the broad-based market is about 17% undervalued already, and consumer services spending from re-opening is resulting in many more opportunities in today’s market. These span from ground transportation, such as undervalued Uber (UBER) and Lyft (LYFT), to travel industry big names such as Delta Airline (DAL) and Caesar Entertainment (CZR), to name few.

LNG

Liquefying natural gas is a way to move natural gas long distances when pipeline transport is not feasible.

Liquefied natural gas (LNG) buyers and sellers are bracing for more uncertainty about Russian supplies and an unclear demand outlook from Europe and top importer China in the run-up to the peak winter season. The destination of U.S. exports has shifted dramatically in recent months, flipping from 75% of tankers heading to Asia to nearly 80% now going to Europe.

Today’s high LNG price is expected to continue until early 2023. Although top U.S. exporter Cheniere Energy seems overvalued, other investment opportunities exist in TechnipFMC (FTI), Shell (SHEL) and Total Energy (TTE).

Lithium

The Inflation Reduction Act provides subsidies for electric vehicles and plug-in hybrids, as long as a minimum proportion of critical minerals, including lithium, comes from the U.S. or its free trade partners. The price of lithium grew over 120% this year, and the market will remain undersupplied for the rest of the decade.

The top picks for lithium producers are Albemarle (ALB), which is the world's largest lithium producer and currently the only lithium producer with a resource extraction operation in the U.S., and Lithium Americas (LAC), which stands to benefit from developing the largest lithium resource in North America.

Disclaimer: The financial products or operations referred to may not be suitable for your investment profile and investment objectives or expectations. It is your responsibility to consider whether any financial product or operation is suitable for you based on your interests, investment objectives, investment horizon and risk appetite. theinvestment411 shall not be liable for any damages arising from any operations or investments in financial products referred to within.

コメント